Did you just get a letter from your life insurance company about an upcoming premium increase? Unless you chose a policy with a fixed premium for a fixed period of time, this is something that happens every year. Here we explain why life insurance premiums increase as the years tick by and the cost of living rises. When we refer to life insurance in this article, it relates to Life cover, TPD (total and permanent disability cover), Trauma cover and Income protection cover.

Why do life insurance premiums increase?

For many people with life insurance, cover is age-rated. That means the cost of cover increases every year as you get older. The reason for this is straightforward. As you age, there’s a higher risk of getting sick, becoming disabled or dying. These possibilities are underpinned by decades of medical data and statistics.

To use an analogy, think of your body as a piece of machinery. When you’re young and all your parts are relatively new, the risk of a breakdown is lower. However, the risk of something going wrong increases as time rolls on. And that means every year presents a higher chance of making a claim on your life insurance policy.

To set annual premium increases, life insurance companies look at a range of data - population data, insurance industry claims data and proprietary data - to determine the likelihood of claims. This statistical analysis guides decisions about life insurance price increases.

Ready to find out more? Get in touch.

What about the CPI life insurance option?

There’s another thing that could be impacting how much you pay for life insurance each year. It’s called the consumers price index (CPI).

The CPI indicates increases in the cost of living for New Zealand households. It considers changes in the prices of goods and services.

Choosing to link the amount of cover you have to the CPI is a way to help the value of your insurance keep up with the cost of living. It’s an option your financial adviser discusses with you when you take out a policy. If you choose the CPI option for your policy, the amount you are covered for will increase a little each year to help the value keep up with the cost of living. The cost of this additional cover is part of your annual premium increase.

What happens if you reduce or increase your life insurance cover?

The amount you’re insured for is another factor that would change your annual premium. As you pay off debts, such as a mortgage, you may want to revisit the amount of cover you have. Some people may choose to decrease the amount of their cover as their mortgage reduces.

Or you could find yourself in the opposite situation. If you moved up to a more expensive home (and a bigger mortgage), you might choose to increase the amount of life insurance cover you have. It’s always best to talk to a financial adviser about what’s right for you before you adjust cover levels so that you have the right level of cover for your needs.

Can you have life insurance with a fixed price?

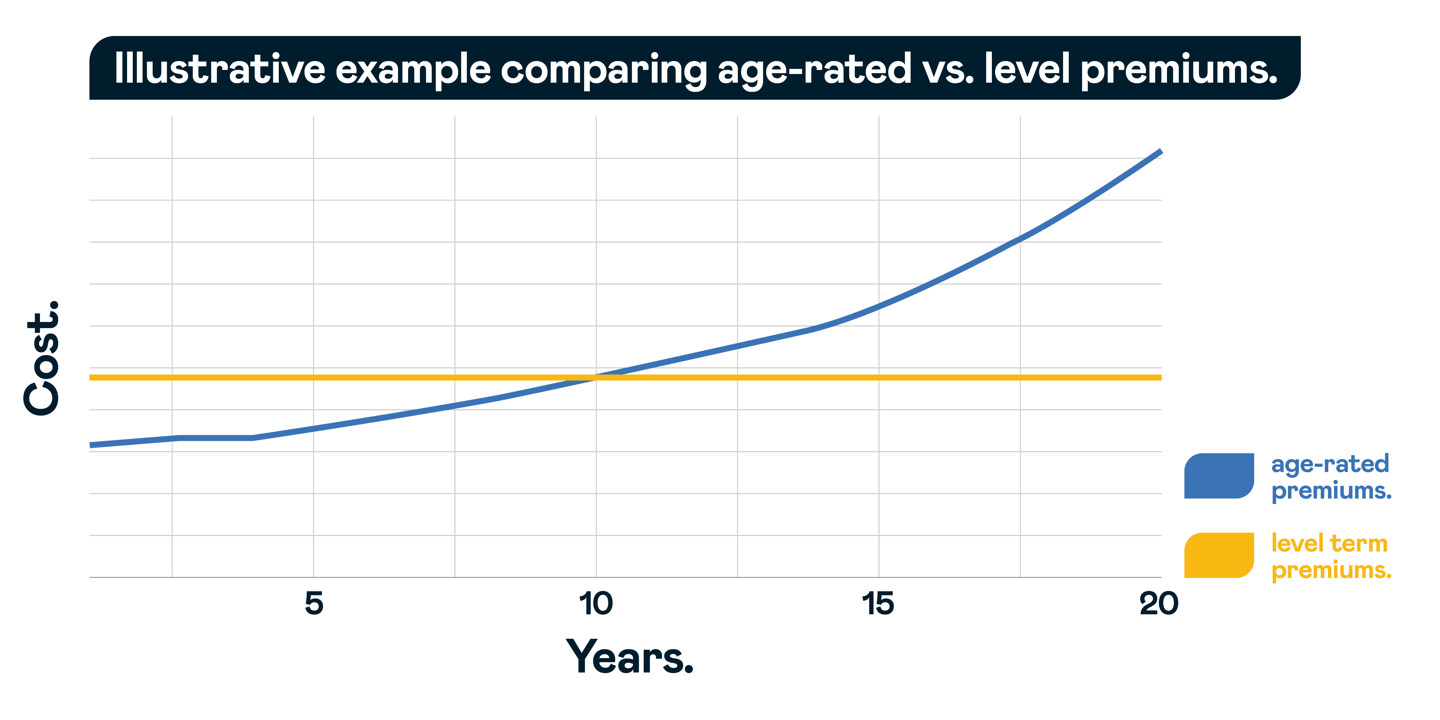

Instead of your premium changing each year as your age increases, there is another option. It’s called ‘level term’, because the cost is consistent. A level term premium is a bit like having a fixed interest rate home loan; the cost stays the same for a fixed period of time that you choose when you take out the policy.

Take a look at the graph below, which shows a 20-year term for a non-smoking, 30-year old female, in good health, who’s taking out Life cover worth $500k. You’ll see that level term premiums stay the same throughout, but they’re higher than age-rated premiums to begin with. With age-rated premiums, these start off cheaper and increase each year as you get older. This example can be helpful to understand the difference between the options, but each situation differs and it’s always best to speak to a financial adviser who can demonstrate this for your specific needs.

Talk to your adviser about all the premium options.

To make the right choice for your situation, it’s always best to talk to a financial adviser. Your adviser can show you a comparison between age-rated and level premium, and explain the benefits of each option. You can also ask about the CPI option, to ensure you have all the information you need to develop a plan which works for you. It’s also good to review your insurance every year to ensure you have the right level of cover. Find a financial adviser.

DISCLAIMER: The information contained in this article is a summary of the key points of the insurance cover(s) mentioned and is general in nature. This article does not constitute a financial advice service. All covers are subject to the definitions, standard exclusions/limitations, terms and conditions contained in the full policy documentation which is available from Fidelity Life or your financial adviser who holds a Distribution Agreement with Fidelity Life. All applications for cover are subject to underwriting criteria.

Find a financial adviser.

Get in touch.

Related articles.

How much cover to get.

Things to think about when choosing lump sums, wait times and payment periods.